Research Note: Writing Call Options for Yield

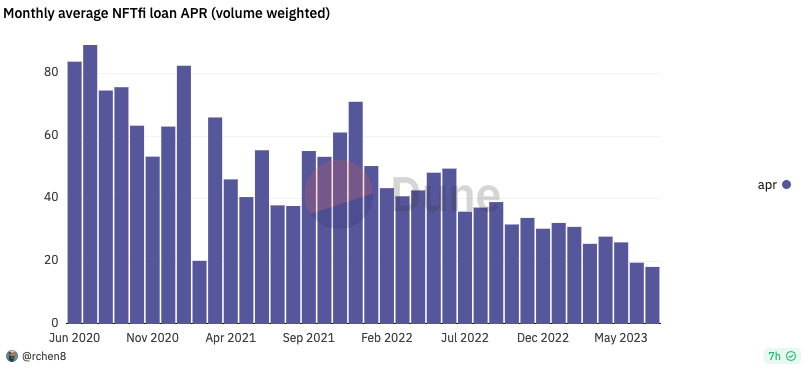

Over the last year, NFT lending has emerged as one of the best ways for liquidity providers to earn consistent returns from the NFT market. As this market matures, competition increases, pushing yields downwards and making the returns less compelling.

There is a new, emerging market in NFTs that offers a similar risk profile for lenders with higher returns: the covered call market. Today, lenders can take advantage of this market to increase their capital utilization, diversify their strategy beyond loans, and potentially increase returns. As early adopters, lenders have the opportunity to take advantage of enhanced yield from an immature market, just as they did before on past protocols like NFTFi and Arcade.

Editors Note: this post is targeted at lenders on Arcade, X2Y2, and NFTFi. While many options terms are defined, it might be helpful to read the CME page if you’re not already familiar with call & put options.

Background on NFT lending and options

When lenders participate in the NFT finance market, they face a default risk. Unlike other types of lending like US Mortgages, NFT loans are non-recourse, meaning that when a default occurs only the asset can be seized. No other assets from the borrower are at risk when they default. Lenders, therefore, experience direct price exposure because, if the underlying NFT is worth less than the debt repayment at loan expiry, a rational borrower will default, leaving the lender with this new asset.

Hook is a covered call option marketplace for NFTs. A covered call option is a contract that gives its owners the right, but not the obligation, to purchase a specific asset at a specific time in the future. On Hook, a user can deposit a NFT, specifying a strike price for which they’re willing to sell that NFT, and an expiration date at which they will sell it. In exchange, the protocol then mints them a call option NFT that they can sell to a trader on Hook’s marketplace. At expiry, the protocol runs a settlement auction to determine the underlying NFT's value. If someone places a high bid above the strike price, the option writer receives just the strike price, the option bidder receives the NFT in exchange for their bid, and the option holder receives the difference between the high bid and the strike price. Otherwise, the writer keeps their NFT.

People often use covered call options to earn income when they hold an asset. By regularly writing covered call options, a writer can collect premiums and make money as long as they don’t write options during the most drastic price upswings. Products like Ribbon automate this call-selling strategy on fungible tokens.

How Lenders earn yield today

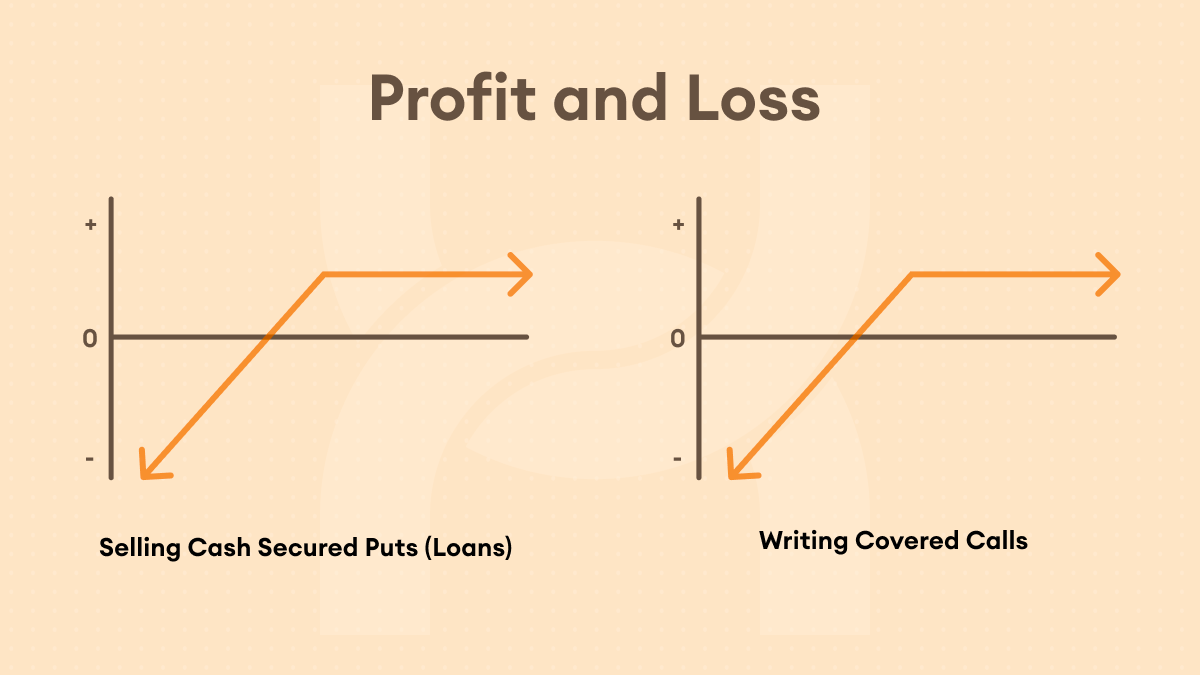

Unlike traditional lending where other factors like credit risk come into play, NFT loans are well-modeled as European-style cash-secured put options. The lender is selling this put, and the buyer is purchasing it.

Selling a cash-secured put means giving someone else the right, but not the obligation, to sell you a specific asset, for a particular price (the strike price), at a specific time in the future (the expiry). If the option holder sells the asset to the writer under this agreement, they’re exercising the option. In exchange for granting someone this right, the seller receives an option premium in return. This option is said to be cash-secured because the full cash value of the strike price is deposited into escrow when the option contract is created, giving the buyer certainty that their option will be exercisable. Finally, a European-style option can only be exercised at expiry.

How does a loan on NFTFi or Arcade work like a put option? From the lender–an option writer– perspective:

- The loan has a strike price equal to its debt repayment, a premium equal to the interest earnings, and an expiration equal to the loan's maturity.

- When the option is sold, the lender deposits the strike price (less the premium they receive) into the contract, making the option cash secured.

- At expiry, the loan can either be repaid or liquidated. If it is repaid, the option expires worthless and the lender can withdraw their collateral. If it is liquidated, then the borrower has exercised their option.

- The option is European style because the borrower can only exercise (cause the lender to receive the underlying nft) at expiration.

Writing cash-secured put options is a time-tested way to earn yields on capital, and lenders are doing this here. Because there are very few ways to hedge, lenders have preferred to write these put options out of the money, with limited price exposure to the underlying asset and a very low default rate.

How do Covered Call Options compare to Cash-Secured Puts?

A covered call option is similar to a cash-secured put but in the opposite direction. Instead of locking the strike price inside the options contract, instead, the underlying NFT is locked. The option offers the holder the right to purchase that locked NFT, instead of the right to sell one.

Interestingly, the payoff for a cash-secured put & a covered call option with the same price is identical. That’s right: this means that lending money against an NFT is the same bet as writing a covered call option, assuming that the strike price of the call option and the debt repayment on the loan is equivalent.

Despite this similarity, there are a few differences to be aware of:

- Just like how loans are often written at conservative LTV to reduce the price exposure to the underlying asset, Call options are normally purchased out-of-the-money to have the highest upside potential for the bidder. This means that the writer of a call option typically has much more price exposure to the underlying NFT than a lender would.

- Unlike loans where the lender does not have the opportunity to participate in the collection appreciation, call option writers can receive all of the price appreciation up the strike price – potentially significantly increasing the earnings on the assets where they’re already lending.

- Lenders on Arcade and NFT Fi are able to transfer their promissory note NFT to other lenders. On Hook, the writer position for the call option is non-transferable.

- On Hook’s call option marketplace, there are no fees, meaning that option writers earn more of the premiums.

- Lenders generally don’t have the ability to seize the collateral of a loan when the underlying asset is in freefall; however, on Hook they can attempt to purchase the (worthless) option from the current owner and close their position.

Case Study: Milady Options vs. Loans

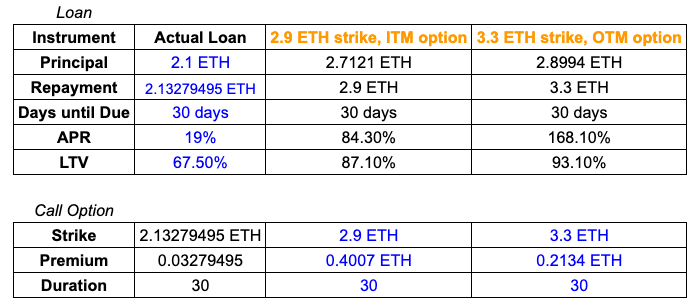

We’ll examine an actual NFT-Fi loan initiated by homerfan33.eth on June 28th.

Borrower: homerfan33.eth

Lender: cx000.eth

Principal: 2.1 ETH

Repayment: 2.134521 ETH

Duration: 30 days

LTV (6/28): 67.4%

APR: 20%

Using Hook’s Loan-to-option calculator, we can convert this loan to the equivalent put options:

Strike Price: 2.13279495 ETH

Premium: 0.03279495 ETH (note: includes NFTFi 5% fee)

Implied Vol: 101%

Because of the put-call parity, we can also create an equivalent covered call option by purchasing a Milady and writing an option on it:

Strike Price: 2.13279495 ETH

Premium: 1.0129 ETH

IV: 93.81%

At the time of the loan, no options with this moneyness were available on Hook; however, the highest IV bids were 80%, which implies a similar risk and yield opportunity for covered call writers.

Let's compare the loan with several calls that we’re available, and see how those would perform in loan terms.

Diving deeper, the prevailing option bids at the time of this loan would have allowed both of these two example options to be immediately sold: the 2.9ETH strike and the 3.3 ETH strike.

In both cases, the lender would have procured a Milady on the open market and brought it to hook to receive the premium. When writing the in-the-money call option, the lender would have had a payoff with a higher APR similar to a more aggressive, high LTV loan (87% in this case). There may not have been borrowers interested in accepting a higher LTV, higher interest loan when this one was created, meaning this could be a new opportunity for higher-risk, higher-yield returns for that lender.

The lender could get even more aggressive with the out-of-the-money, 3.3 ETH strike option. The high bid for this option at loan-origination time was 0.2134 ETH. Writing this option would be similar to writing a loan where the repayment was greater than the current underlying value: unless the price of the collection increased, the borrower would likely default. On the other hand, this exposes the lender to upside in the collection, and the potential to earn a substantially higher APR on the deployed capital. If the lender was optimistic about miladies, this could be a good option.

The Case for Covered Calls

The most popular assets on NFT lending protocols have had a general upward trend even in this bear market. Covered calls finally give lenders the opportunity to participate in that upside as they earn yield on their money. While covered calls can’t – and don’t – replace writing loans, adding them to your strategy can help increase a lender’s capital utilization and returns.

Beyond the return profile, there are several factors lenders should also consider when writing calls:

- Hook has a rewards program in place which is currently call-writer-constrained, potentially offering more rewards than lending protocols.

- There are more individuals looking to make a leveraged bet towards the upside in NFTs than there are holders of high-value assets looking to hedge, indicating a robust market for selling calls.

- Hook's vBids product allows users to place collection-wide offers that automatically reprice as floor prices change, providing more liquidity and flexibility in the calls market – when you want to write an option, a bid should be there already.

How can lenders take advantage of Covered Calls now

To take full advantage of this opportunity, lenders should consider writing call options into standing offers when the implied volatility of these options is more attractive than the loans.

To write a covered call, a lender can purchase an NFT from the collection on any marketplace, like Blur. Then, a lender should visit the portfolio tab on Hook.xyz to create + sell a call option using this asset.

Here are some of the strategies a lender should consider:

- Write in-the-money options which offer a lower risk of loss but less upside when the asset appreciates.

- Write out-of-the-money options which provide higher premiums relative to the risk, more liquidity for the options, and additional upside.

- Borrow NFTs from their counterparties or an OTC desk and write calls on those assets, avoiding the price impact of those assets.

At Hook, we’ve created a loan-to-option and option-to-loan converter in Google Sheets to help lenders understand how to write call options. Feel free to copy it and modify it here.

In conclusion, while the lending market has traditionally been a go-to strategy for those with ample ETH, the covered call market's dynamics and potentially higher yield make it an attractive supplement that all lenders should be paying attention to. As liquidity returns to the NFT market, the trend of decreasing APR on loans will likely continue… at the same time, renewed growth should increase option premiums, and therefore the yield that could be earned from covered calls.

--

This content is provided by Abstract Labs, Inc., for informational purposes only and should not be interpreted as investment, tax, legal, insurance, or business advice. Abstract Labs, is a software development company.

Neither Abstract Labs, Inc.. nor any of its owners, members, directors, officers, employees, agents, independent contractors, or affiliates are registered as an investment advisor, broker-dealer, futures commission merchant, or commodity trading advisor or are members of any self-regulatory organization.

The information provided herein is not intended to be, and should not be construed in any manner whatsoever, as personalized advice or advice tailored to the needs of any specific person. Nothing on the Website should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any asset or transaction.

The commentary and opinions provided by Abstract Labs, Inc., are for general informational purposes only, are provided “AS IS,” and without any warranty of any kind. To the best of our knowledge and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable at the time of publication.

All content provided is presented only as of the date published or indicated and may be superseded by subsequent events or for other reasons. As events markets change continuously, previously published information and data may not be current and should not be relied upon.