Introducing Volatility-Based Bids

Last week we shared the audit report for an upcoming product - volatility-based bids or vBids. vBids are a new bid type that make it much easier to participate in Hook’s option market. While we prepare these for launch, we’re excited to reveal more details about them.

What is a vBid?

Bidding on options is notoriously complicated as they are difficult to value with the price of their underlying asset constantly changing. Professional traders continuously update their bids to keep up with changes in the market. While this may seem daunting for casual options traders, there’s a simpler way to think about pricing options.

For some background - when a trader places an offer on a specific option, they’re expressing a view on its likeliness of expiring in the money. When the price of an asset changes quickly the odds an option expiring in the money are higher. Baked into every option's price is an “implied volatility” which isolates this factor.

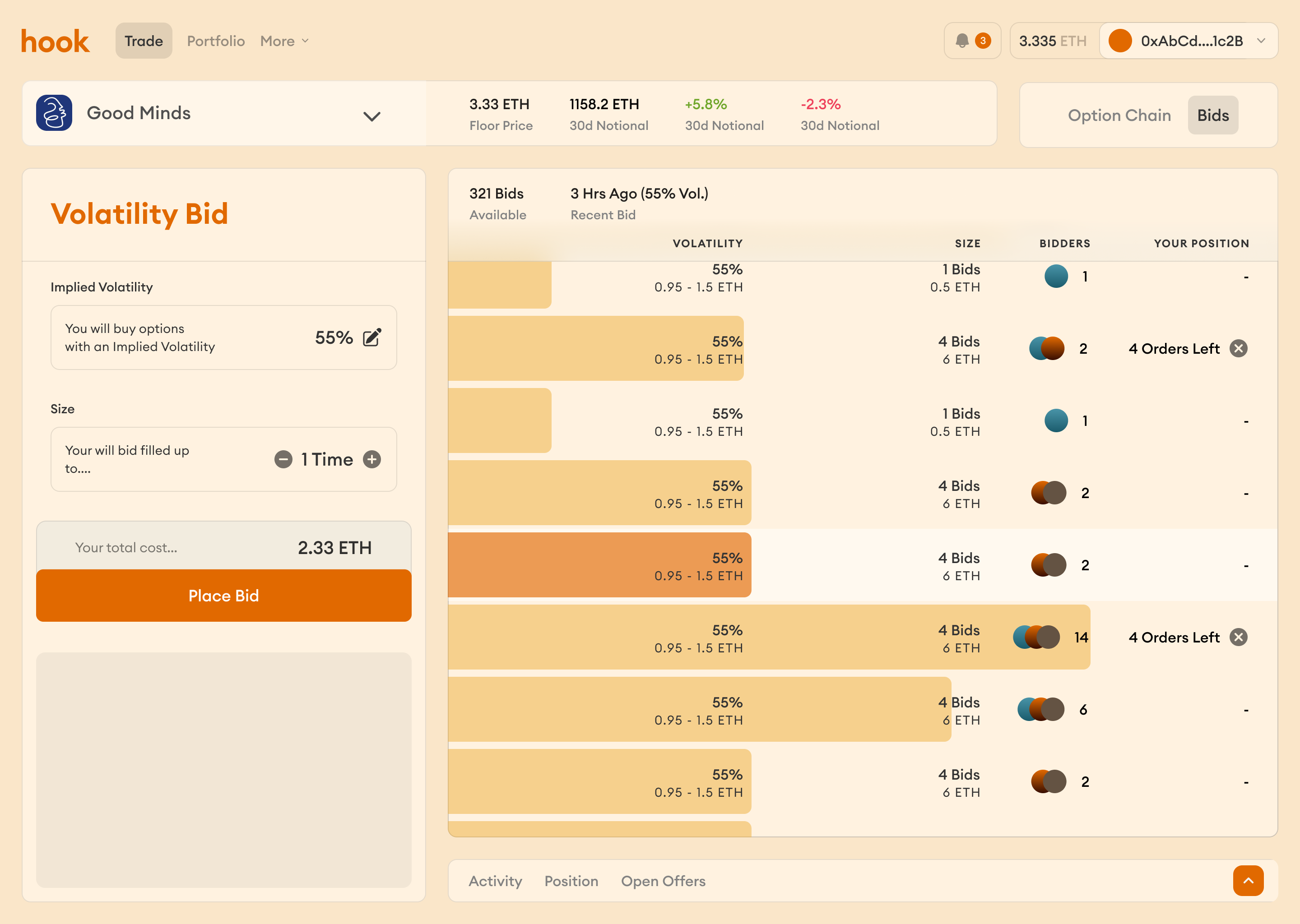

Hook now allows traders to create a bid with a specific implied volatility instead of an option price. The protocol continuously computes the options price, allowing everyday traders to compete with the pro’s high-speed bids.

vBids with Hook

Hook simplifies the process of making vBids. Traders no longer need to constantly make, update, and cancel bids as time elapses. Instead, they can select an implied volatility and the protocol will automatically do two things:

- Calculate the price of the option in real-time

- Purchase the option if the implied volatility for the bid is met

For example, say a trader believes the price of Miladys will increase and they’d like to purchase call options to get levered exposure. The trader can identify and bid a fair implied volatility by looking at outstanding bids or the current realized volatility in the market. Hook’s smart contract will automatically compute the exact wETH amount to bid on behalf of the bidder once the volatility is reached. If the trader is right, their option will appreciate in value as the price of Miladys increases.

To make this process even easier and more capital efficient, a trader’s wETH balance does not need to be deposited in the protocol until a bid is accepted. This will be familiar to users of marketplaces like Opensea with their offers. Hook also surfaces this bidding in a simple way, allowing traders to see both the cumulative value and number of offers placed at each volatility level.

Why vBids over wETH bids?

There are three main areas that make vBids more attractive than wETH-based bids.

First, vBids are more user-friendly. Once an implied volatility has been selected, the protocol will automatically compute the price of the option. When making a bid in wETH terms, traders need to constantly readjust their bids based on changes in the underlying asset to ensure the bid remains competitive. Because vBids automatically update in response to real-time market conditions, individuals can make bids that are competitive with those using the systematic trading infrastructure.

Next, traders can profit on their volatility projections by selling when there’s secondary liquidity available. This can be done by bidding at low implied volatilities and listing at higher ones or vice versa.

Lastly, bids will likely not be filled instantly since NFT options are an emerging market. Traders can safely place vBids with longer durations, knowing that the actual sales price will be computed at the exact moment of the sale. As a bonus, implied volatility is usually consistent across all options for a specific asset, making it easier for traders to bid on multiple options at once since they don't have to constantly recompute prices.

How are the final prices for vBids determined?

With vBids, the call options price can be calculated in real-time using the Black-Scholes formula. All of the inputs to Black Scholes are known, including the bid’s volatility, the asset’s spot price, strike price, expiration, and the risk-free rate. Hook currently uses a floor price oracle to compute the spot price and may offer other oracle options for bidders in the future to allow for further bid customization. The bidders just pay this value (or less), and the seller of the option receives that amount minus fees.

When will Hook release vBids?

vBids will be live next month.

If you haven't already done so, follow Hook on Twitter and turn on tweet notifications to be the first to know when vBids and other products go live.