Going Delta Neutral with Hook and nftperp

Over the last several months, NFT Finance primitives have expanded the horizon of NFT trading beyond buying and selling NFTs. Traders can now use leverage to long or short NFT collections on nftperp and can trade NFT-backed call options on Hook.

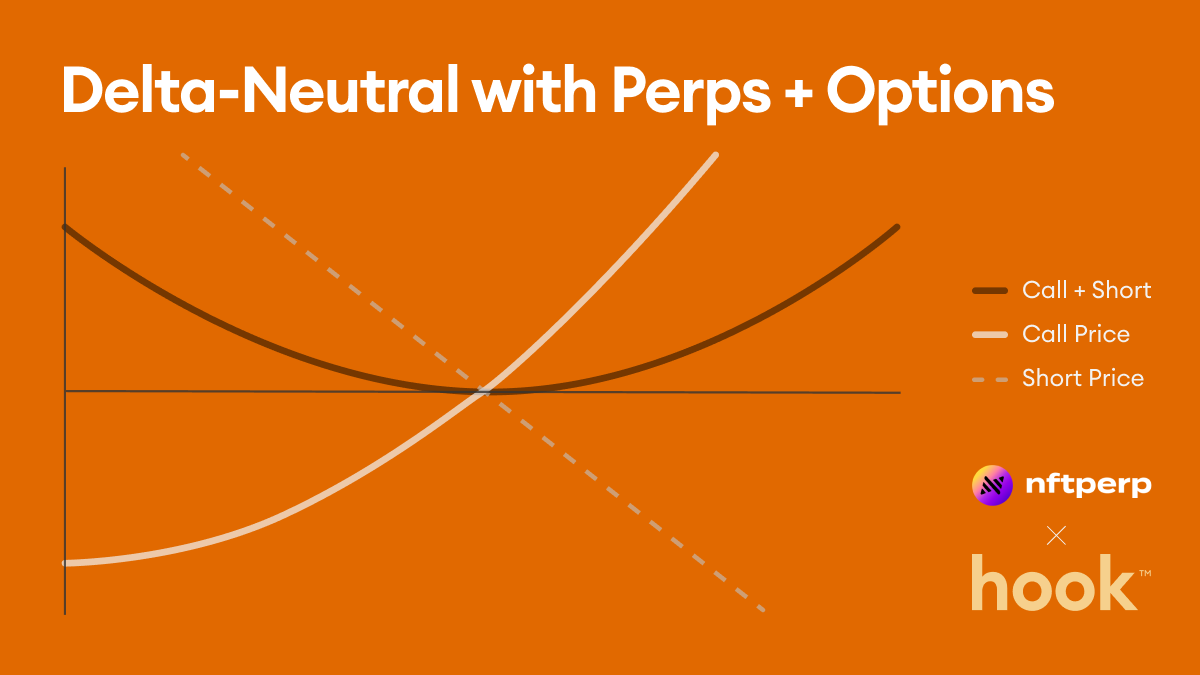

One strategy that is common in both traditional financial markets and in DeFi through DOVs (DeFi Option Vaults) is longing (buying) a call option and shorting the underlying asset. For the first time, this strategy is available with NFTs because nftperp and Hook now have liquidity in the same market - Miladys.

What is Delta?

Delta is a metric measuring the price sensitivity of a derivative to a $1 change in its underlying asset. For example, if the price of an apple increases by $1, but the price of an apple derivative only increases by $0.50, then the delta of the apple derivative is 0.50.

For options, delta values are positive for calls (between 0 and 1) and negative for puts (between -1 and 0). The value of a delta in percentage terms gives an approximate probability that the option will finish in the money.

It’s important to know that the delta of an option changes as the price of the underlying asset changes. As options get closer to being in the money, their delta will go up and vice versa. This is fairly intuitive as the more an option moves or moves past being in the money, the higher the probability that it will end up in the money.

What is Delta Neutral?

A portfolio is delta neutral when the deltas of its various positions sum to 0 through deliberate balancing. Delta-neutral strategies limit a trader’s exposure to movements in the underlying asset. With a delta-neutral strategy, the price of an asset or even the whole market can decrease but the position as a whole can still increase in value.

How can we use a Delta Neutral strategy with NFTs?

With the introduction of new NFT x DeFi primitives like Hook and nftperp, NFT traders can reduce risk by using a delta-neutral strategy. We’ll walk through one common delta-neutral strategy that could be implemented with Milady’s today. This strategy involves longing a call option while shorting a perp.

- Purchase a Milady call option on Hook.

- Calculate the delta of the Milady call option.

- Short the delta of the Milady call option on nftperp.

Perps are delta one, meaning they move directly with the underlying asset. This is not perfect (especially when funding rates are considered), but a close approximation. Example: If the delta of the Milady option is 0.6, the trader must short 0.6 Milady on nftperp.

Traders must deposit the necessary amount of collateral needed to short the Milady’s option delta on nftperp. The trader can use less collateral on nftperp by using leverage, but they will increase their risk of liquidation.

- The options’ deltas in the portfolio will likely change over time. The trader will have to rebalance their portfolio to remain delta neutral. Many traders will accept some change in delta without re-hedging because the re-hedging costs are greater than the losses it protects against. This strategy comes down to risk tolerance on re-hedging and implementing it in a deliberate way.

If the option’s delta increases, the trader must short more Milady to stay delta neutral.

Amount of Milady to short = Milady option delta increase.

Conversely, as the option delta decreases, the trader must cover a portion of their short position.

Amount of Milady short to cover = Milady option delta increase.

If the price of Milady decreased significantly, the trader will have earned from the short minus the call’s premium.

If the price of Milady increased significantly, the trader will have earned from exercising the option minus the loss from shorting. Hook uses cash-settled call options, meaning the option holder will receive the spread between the sale price and the strike price.

This strategy also scales if a trader has more than one Milady option in their portfolio. Assuming the options have different deltas, the trader can calculate the portfolio’s total delta and then short that amount on nftperp.

Example

Milady Floor Price = 1.5 ETH

Option Expiration Date: 30 Days from Today

Option Strike Price: 1.7 ETH

Option Premium: 0.1 ETH

An NFT trader is bullish on the future of NFT finance and wants to use nftperp to secure its retroactive airdrop. The trader does not have a strong opinion on where the market is headed, so would prefer not to only have single-sided market exposure. The trader decides to use a delta neutral strategy, specifically by longing a call and shorting a perp, to secure the retroactive airdrop while reducing their risk.

The trader purchases a Milady call option on Hook with a 0.6 delta. The trader then shorts 0.6 Milady on nftperp. Over the next 30 days, the option’s delta does not move much, so the trader does not re-hedge. At the expiration date, the option is in the money, so the trader exercises the option and closes the short position. The trader receives the spread on Hook while losing a small amount from the short position on nftperp.